During much of this year’s Georgia legislative session, a contingent of Republican legislators were determined to rein in the state’s largest corporate tax break program which benefits film and TV producers such as Netflix and Disney.

The House bill 1180 that came out in February would have added more hurdles to receive the maximum 30% tax credit, such as incentivizing producers to work in rural counties or hire more Georgia-based crew. It also limited how many tax credits could be transferred in a given year to 2.5% of the entire state budget, which would currently be around $930 million.

For a time, entertainment lobbyists were resigned that some semblance of this bill would pass and worked to ensure any changes wouldn’t encourage Lionsgate and NBCUniversal to move more productions to places like Canada or England, which also have generous tax credit systems.

But after legislators in the Senate made some ill-fated changes earlier this month, the bill ultimately died on the vine Thursday.

The new provisions would have given favored status to soundstages like Assembly Atlanta in Doraville, Trilith Studios in Fayetteville and Shadowbox Studios in Atlanta over others like Electric Owl in Atlanta, Eagle Rock in Norcross and Stone Mountain and Tyler Perry Studios in Atlanta. Even last second changes on Thursday that would only trigger the tax credit transfer cap under extreme circumstances couldn’t muster enough support on the Senate side as the clock ran out.

Kasey Carpenter, a Republican House representative who pushed for the changes, noted in a text to The Atlanta Journal-Constitution on Friday that in the end, “the Senate was not interested.” Other priorities, such as changes in immigration and voting rights, took precedent this year.

Here are four takeaways about the efforts to modify the tax credit system:

1. The Georgia film business gets to enjoy the status quo

The current film and TV tax credit system, which passed in 2008, will remain as is for now. The only previous change featured stronger auditing requirements starting in 2021.

The program’s relative stability, simplicity and generosity has made it appealing to TV and film producers for more than 15 years. Hundreds of TV shows and films now shoot in Georgia each year providing tens of thousands of jobs and more than $4 billion in annual direct spending from studios.

“It’s not often the state Senate does the right thing, but killing HB 1180 is exactly what the Georgia film industry needed to restabilize after a long year of strikes and economic uncertainty,” said Beth Moore, a former Georgia House rep and film industry attorney with Arnall, Golden & Gregory.

Over the years, the state has attracted successful TV series such as AMC’s “The Walking Dead,” Netflix’s “Stranger Things” and Fox’s “The Resident” along with big-budget film franchises like “Black Panther,” “Hunger Games” and “Guardians of the Galaxy” flooding into town.

Currently, Georgia studios are filling with projects such as a live-action Disney film “Moana,” Kevin Hart’s pricey Peacock series “Fight Night,” Steve Harvey’s durable game show “Family Feud,” Kevin Bacon’s new Amazon series “The Bondsman” and Netflix’s romance drama “Sweet Magnolias.”

Credit: Natrice Miller/AJC

Credit: Natrice Miller/AJC

2. This break may be temporary

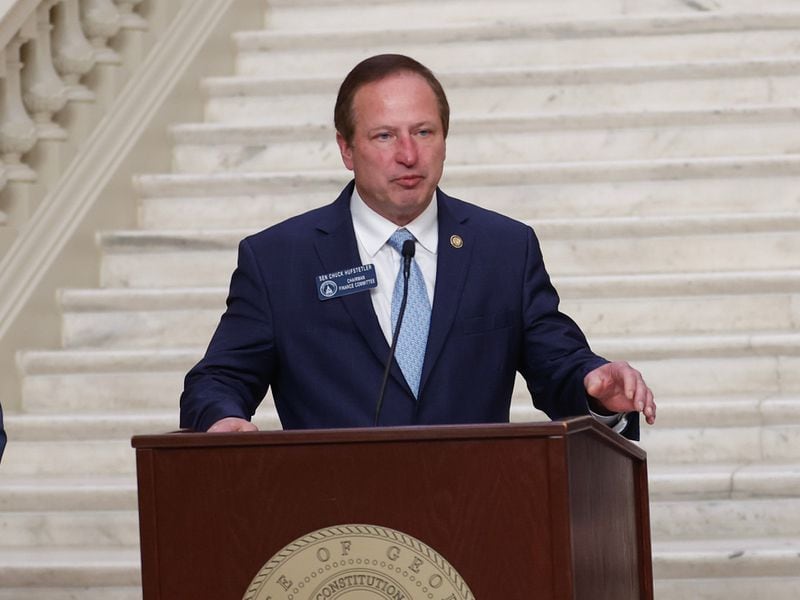

Several state legislators, led by Republican Sen. Chuck Hufstetler, entered the year wanting to place safeguards on the tax credit system which has always been uncapped, meaning there is no technical limit to how many tax credits the state could hand out any given year.

In recent years, the state has certified more than $1 billion a year to big media companies such as Warner Bros. Discovery, Apple, DC Studios and NBCUniversal. Legislators were worried that if the state budget, which has seen surpluses in recent years, suddenly saw big deficits like it did after the 2008 recession, the film and TV tax credits could siphon away needed dollars from priorities like education and law enforcement.

“I think we’ll be back at this again next year,” said Stephen Weizenecker, an Atlanta-based entertainment attorney.

Randy Davidson, publisher of Georgia Entertainment News, said the TV and film industry hates uncertainty and a bill that signaled no more changes for a few years would have reduced that uncertainty.

“Unfortunately, that didn’t happen,” Davidson said. “In the end, we have to find some way of dealing with the uncapped nature of the system to appease Chuck Hufstetler and the tax incentive hawks.”

Long Tran, a Democratic House representative who dabbles in acting and helped organize a Georgia Film Day to bolster the industry last week, said regardless of what happens down the road, “we have to make sure the credits don’t become a burden so that film is a permanent part of industry in Georgia.”

Credit: RODNEY HO/h

Credit: RODNEY HO/h

3. The little guys get a reprieve

The House bill would have effectively made it more difficult for smaller filmmakers, like those who make commercials, to aggregate their projects to qualify for the tax credit.

Peter Siaggis, who runs commercial producer Spots Films in Atlanta and shot 15 commercials in Georgia last year, said if the bill had passed, he might have had to cut staff and close his offices. “I’m glad they came to their senses,” he said. “It alleviates a lot of business stress.”

Jessica Felder, an accountant who has worked on a range of smaller independent productions, said new auditing requirements meant to reduce fraud have already made compliance costs more burdensome by adding a lot more paperwork. And it has taken a lot longer to get the tax credit, she noted.

Bigger companies like Netflix and NBCUniversal, on the other hand, have size and scope and a team of accountants to ensure they can get the tax credits.

Credit: Arvin Temkar/AJC

Credit: Arvin Temkar/AJC

4. The film and TV business has become a true force in the state

Sixteen years ago, the TV and film business in Georgia was barely a footnote. But as the industry has matured and more soundstages have been built, its power in the legislature has grown as well.

Now there are multiple lobbyists at the state Capitol representing big studios (the Motion Picture Association of America or MPAA), the soundstages (the Georgia Screen Entertainment Coalition of GSEC) and a broader array of TV and film interests (The Georgia Production Partnership or GPP). Some studios hired their own individual lobbyists as well.

“The film industry in Georgia is on the precipice of being a complete ecosystem in the state, but we are not there yet,” said Craig Miller, an independent filmmaker and producer who is a key player with GPP. “The support of the leadership to maintain the incentive intact is a vote of confidence that will only help our industry to grow.”

Although Gov. Brian Kemp doesn’t evangelize for the industry the way former Republican governor Nathan Deal did in the early 2010s, he has quietly supported the tax credit system. He even attended a film office 50th anniversary event hosted by the state film office at the Fox Theatre in February and spoke on the dais.

“We’re proud Georgia is a global leader in this industry and that we are continuing to see growth in this field,” he said.