Among Democrats’ many gripes with the House Republican health care bill is that it’s missing a special protection for veterans.

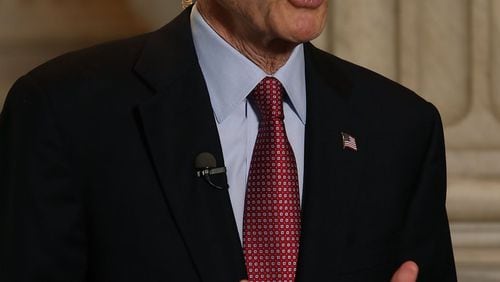

"What does Trumpcare do? Yank tax credits away from veterans unlike any other American," said Sen. Richard Blumenthal, D-Conn., at a May 9 press conference.

This issue is more complex and less far-reaching than Blumenthal’s exaggerated one-liner suggests. It is possible that if the Republican bill were to become law in its current form, a subset of veterans might not get financial assistance to choose private insurance over health care through the Veterans Administration.

But the language of the bill actually treats veterans like “any other American,” as opposed to what Blumenthal said. And there are regulations the Trump administration could pursue to blunt any impact.

Both the Affordable Care Act and the Republican health care bill (the American Health Care Act) provide government financial assistance to low-income Americans buying health insurance plans on the individual market, through tax credits that subsidize premiums. To qualify, a person cannot be eligible for other affordable health insurance options such as employer-provided insurance or Medicaid, or for military-related health care.

But there is an exemption to that rule under the Democratic-supported Affordable Care Act. Veterans who qualify for Veterans Administration health care (not all do) but aren't enrolled in that system are eligible for subsidized premiums.

The Republican bill doesn’t include language that would have the same effect. This means that if the Republican bill were to become law in its current form, some veterans might not be able to access the tax credit.

Blumenthal said the Republican bill in its current form could affect as many as 8 million veterans, the approximate number as of June 2014 who qualify but choose not to enroll for VA benefits, according to the Congressional Budget Office.

But not all 8 million are in the market for a tax credit to help them buy private insurance. Many get health care through other means, such as Medicaid, their employer, or TRICARE, the military health benefits program.

A report by the Urban Institute, a social and economic policy think tank, found that subsidized premiums under the Affordable Care Act played a big role in the 40 percent drop in uninsured veterans between 2013-15. But the Urban Institute's numbers suggest the omission from the Republican health care bill would affect far fewer than 8 million veterans.

In 2010, the year Obama signed the Affordable Care Act, 520,000 uninsured veterans were eligible for subsidized premiums, according to a 2012 report. By 2015, that number dropped to 225,000. And it's still a subset of these groups who would be affected by the Republican bill: — those who qualify for subsidies and VA benefits.

For scale, there are 21.6 million living veterans as of 2014.

Interestingly, an earlier version of the Republican health care bill did include the relevant language, but it was removed from the final version that passed the House — a point that Blumenthal's staff emphasized to us.

Including non-budgetary language, such as this veterans provision, could derail Republicans’ plan to get the bill through the Senate using a special procedure called reconciliation.

Rep. Phil Roe, R-Tenn., said existing federal regulations stemming from the Affordable Care Act will be able to ensure VA-eligible veterans can qualify for the tax credit. Why? The Affordable Care Act veteran exemption isn’t found in the text of the Affordable Care Act itself. It’s actually a 2012 IRS rule.

However, regulations applied to one law don’t automatically apply to that law’s replacement, said Lisa Zarlenga, a Washington lawyer for Steptoe and Johnson who served as the Treasury’s tax legislative counsel during Affordable Care Act implementation. If the Republican health bill becomes law, the Treasury and IRS might decide that the Affordable Care Act veterans rule carries over, but it’s not guaranteed, she said.

Our ruling

A reasonable person might hear Blumenthal’s statement and think that under the Republican health care bill, most or all veterans won’t get a tax credit to which they are entitled. It’s much more nuanced than that.

Blumenthal's statement is partially accurate but leaves out important details, so we rate it Half True.

“What does Trumpcare do? Yank tax credits away from veterans unlike any other American.”

— Sen. Richard Blumenthal, D-Conn., on May 9, 2017 in a press conference

About the Author