Eric Wittenstein estimates he spent about $1,500 out-of-pocket during his first year as a world history teacher at Cross Keys High School to decorate his room and ensure students had the supplies needed when he started making assignments.

He doesn’t like the idea of losing a tax deduction that applies to those kind of expenses.

The Tax Cut and Jobs Act, a proposed House GOP tax bill, would eliminate a $250 educator expense deduction, which helps offset some costs of classroom materials.

“They’re taking money out of teachers’ pockets,” Wittenstein said Tuesday. “We already live in a society where teachers are grossly undervalued, underpaid and overworked, where school funding that actually reaches teachers is ludicrous.

“This is just a continuation of that same trend.”

Several provisions in the bill that impact education include plans to allow parents to invest up to $10,000 a year, tax-free for education-related expenses and doing away with the deduction for interest paid on student loans.

According to the IRS, a household can deduct up to $500 for unreimbursed expenses if both spouses are teachers, principals, instructors, counselors or aides who work more than 900 hours annually at elementary or secondary schools. A reporter reached out to about a half-dozen teachers for this story. None knew the deduction existed.

The educator expense deduction is an above-the-line deduction, which a taxpayer is allowed to subtract from his or her gross income for that taxable year.

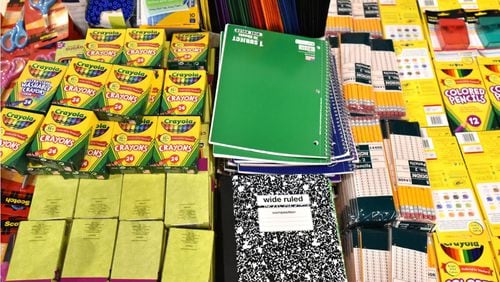

K-12 teachers, especially those in high-poverty schools, report buying pens, pencils, poster boards as well as computer software to make sure students have the supplies needed for their daily lessons. Some mention buying paper towels and toilet paper, as well as hand sanitizer and even food for their students.

A 2011 survey by Adopt A Classroom, which helps provide resources to teachers across the country, found 91 percent of teachers surveyed reported buying food and clothing for their students. Various studies point to hungry children being unable to learn.

David Yancey, an eighth-grade social studies teacher in Rockdale County, said he often spends close to $500 each year on supplies for his classroom. He’s heard stories from other colleagues who’ve spent twice as much.

“I’m cheap in real life, so I have to be frugal with the decisions I make,” he said.

He said he buys dry-erase markers, construction paper, scissors and copy paper for handouts. He purchased a laptop so he could use programs he could not download to his district-issued computer. Candy also is a must-have supply, he said, because of the incentive it gives his students to complete their work.

Though he didn’t know about the deduction, he knows how hard teachers’ pockets are hit while providing for their students.

“I’m worried about the trend,” he said, mentioning other education-related impacts he’s heard the proposed bill includes. “Where is this going to end?”

From the IRS website:

Topic Number: 458 - Educator Expense Deduction

If you’re an eligible educator, you can deduct up to $250 ($500 if married filing jointly and both spouses are eligible educators, but not more than $250 each) of unreimbursed trade or business expenses. Qualified expenses are amounts you paid or incurred for participation in professional development courses, books, supplies, computer equipment (including related software and services), other equipment, and supplementary materials that you use in the classroom. For courses in health or physical education, the expenses for supplies must be for athletic supplies. This deduction is for expenses paid or incurred during the tax year.

About the Author