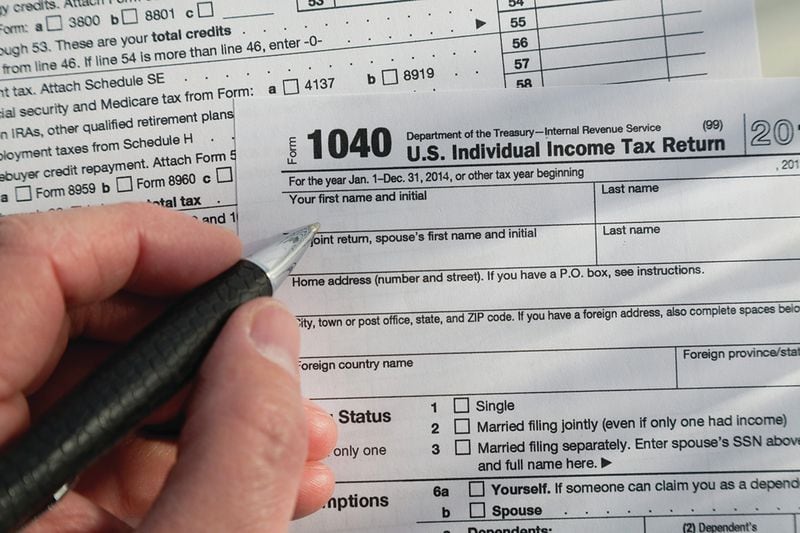

Death, taxes and whining: some things are unavoidable.

But despite the special pain you feel as you write out the check to the Internal Revenue Service this year, you can console yourself – at least a little – with the knowledge that the tax burden you bear for being in Georgia is less onerous than the weight you'd carry in most other states, according to a ranking released this week by WalletHub.

Georgia ranks 36th, with an average tax burden that is nearly 40 percent lower than the tax load carried by the average resident of New York, according to the calculations of the Washington, D.C.-based credit company.

The Georgia tax burden, though not the highest in the South, is slightly higher than average.

The company compared the 50 states based on the three components of state tax burden — property taxes, individual income taxes, and sales and excise taxes — as a share of total personal income.

WalletHub figured that the critical factor is not the quantity of taxes, but the share of income they eat up. Which may be why Mississippi has the highest tax burden in the South, with more than 9 percent of income going to taxes, according to WalletHub.

The study did not try to measure what taxpayers get for their payments. It did not factor in the value – for better or worse – of the services a resident receives in exchange for taxes. And it did not include any measure of living costs, other than taxes and income.

Highest burden was New York: more than 13 percent of the average income went to state taxes. In second place was Hawaii, where 11.57 percent of incomes go to state taxes.

The lowest burden was in Alaska, where state taxes swallow slightly less than 5 percent of income.

Georgia was near the middle of the pack among southern states, behind Mississippi, Kentucky, Louisiana, North Carolina and Texas.

Highest burden – state taxes as share of income

1. New York (13.04 percent)

2. Hawaii (11.57 percent)

3. Maine (11.02 percent)

4. Vermont (10.94 percent)

5. Minnesota (10.37 percent)

36. Georgia (8.09 percent)

Source: WalletHub

Lightest burden – state taxes as share of income

46. New Hampshire (7.07 percent)

47. Florida (6.64 percent)

48. Tennessee (6.47 percent)

49. Delaware (5.68 percent)

50. Alaska (4.94 percent)

Source: WalletHub

Southern discomfort – state taxes as share of income

14. Mississippi (9.32 percent)

21. Kentucky (8.79 percent)

27. Louisiana (8.43 percent)

30. North Carolina (8.32 percent)

33. Texas (8.15 percent)

36. Georgia (8.09 percent)

39. South Carolina (7.88 percent)

43. Alabama (7.24 percent)

47. Florida (6.64 percent)

48. Tennessee (6.47 percent)

Source: WalletHub

About the Author