In 2014 and 2015, an eager businessman named Dwayne Edwards made the rounds in Georgia and Alabama, talking up his plans to buy and renovate assisted living facilities to serve frail elderly people.

Before long, Edwards got what he was seeking from local officials: almost $62 million in bond financing that allowed his companies to buy and renovate nine assisted living homes in the two states.

It didn't take long, however, for the deals to melt down. Edwards and his business partner Todd Barker feuded. By last year, a management company found some bills for important services such as food and utilities hadn't been paid, and maintenance had deteriorated at some facilities, according to court filings. And then in January, came the big blow. Edwards and Barker were sued by the Securities and Exchange Commission in a financial fraud case. The agency claimed their businesses improperly used bond dollars tied to one project on other senior homes and other expenses, in violation of what they had promised bond buyers.

Credit: Carrie Teegardin

Credit: Carrie Teegardin

"Their money was actually being used to fund an ever-expanding web of affiliated facilities and the personal expenses of Edwards and his friends and family," the SEC's Andrew M. Calamari announced when the case was filed.

The case has another twist: Money raised by eight of the nine bond offerings was used to buy facilities from Atlanta businessman Christopher Brogdon, who had been previously sued by the SEC in a giant case involving the misuse of bond financing for senior living facilities.

Today, the SEC case involving the Edwards homes is almost over. He has settled and agreed to stay out of municipal securities in the future. He could not be reached for comment. His attorney did not respond to repeated interview requests.

Not long after the SEC filed its complaint, a judge quickly turned over management of the assisted living facilities to a receiver. The nine facilities -- six in Georgia and three in Alabama -- are now on the market, waiting for another eager owner to take charge. So far, they haven't been sold.

Assets in the case will be used to try to make investors whole.

But what about the hundreds of elderly people who have grown frail or forgetful, who rely on the facilities for their care?

A spokesman for the court-appointed receiver, Derek Pierce, said residents shouldn't be alarmed when a court appoints a receiver to take over a facility. 'The receiver’s goal is to well position the facility for new ownership," Justin H. Wilson told the AJC in an email. "To do that, the receiver strives to improve performance and operations and increase census. Running the facility well and ensuring residents are well provided for are imperative to ensuring the facility is heading in the right direction and attractive to a potential owner."

Marsha Jones said her 87-year-old mother received great care while Edwards was running the Social Circle facility that is among homes at issue in the SEC case. She said the good care has continued, but she said the lawsuit has resulted in turnover and uncertainty for the residents and their families.

"You do not know who is going to come in," Jones said. "There are a lot of residents and family members worried that somebody else will come in and raise rates or change things to the point where they may have to find another place. That's a concern."

After Jones had placed her mother in the facility, she later went to work at the home, first as an office manager and later to handle marketing and activities for residents. Today, she volunteers there.

Jones described Edwards as a caring person who had worked in senior care for years and wasn't just all about business. She said Edwards worked with families whose finances were tight and got to know the residents personally.

"It felt like a family," she said.

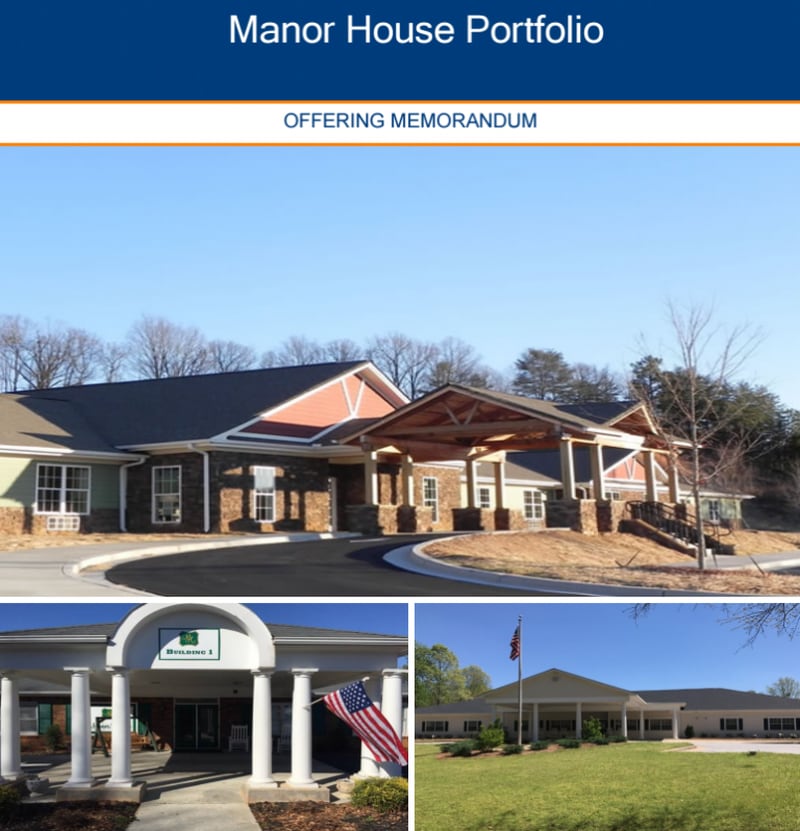

These are the assisted living facilities involved in the case that are now for sale:

Manor House of Columbus - Columbus GA - 60 units

Manor House of Douglas - Douglas GA - 57 units

Manor House of Gainesville - Gainesville GA - 42 units

Manor House of Montgomery - Montgomery AL - 60 units

Manor House of Opelika - Opelika AL - 32 units

Manor House of Rome - Rome GA - 60 units

Manor House of Savannah -Savannah GA - 34 units

Manor House of Social Circle - Social Circle GA - 91 units

Manor House of Waterford - Montgomery AL - 49 units

The Atlanta Journal-Constitution is interested in studying how senior living and long-term care facilities are working. Do you live in an assisted living facility? Do you have a relative in a nursing home? Please share your experiences with veteran investigative reporter Carrie Teegardin, who has written about long-term care and health care issues for years. You can email Carrie at cteegardin@ajc.com.

About the Author