Tyrone Jenkins sat in his insurance agent’s office on Friday, relieved about his health insurance. After all the upheaveal and news over skyrocketing Obamacare premiums, Jenkins will actually see his coverage costs plummet next year. He’ll pay less than half in 2018 what he did in 2017 for similar coverage.

How can this be?

Jenkins doesn’t like the answer. Thanks to decisions made in Washington in recent months, it’s possible because a new and costly inequality has opened up between some policyholders. The cancellation of one subsidy brought in another that benefits people in Jenkins’ position — while leaving other policyholders to take a bigger hit, some to the point they can no longer afford coverage.

And Jenkins the taxpayer will be subsidizing this situation even more, along with other Americans.

“In some stuff it’s kind of frustration,” Jenkins, a forklift driver who lives in Lee County, said of Washington’s management of health care.

Jenkins said he “really” likes his plan, but he really doesn’t like that other people’s premiums are skyrocketing at the same time. And if it adds to government debt, he thinks policymakers should consider the burden on future taxpayers: “It’s the younger generation that’s coming up.”

Open enrollment for the Affordable Care Act, also known as Obamacare, is now three weeks underway. Enrollment is continuing at a ferocious clip, and situations such as Jenkins' may be one reason why.

It partly gets back to a controversial decision by President Donald Trump.

For months Trump threatened to cancel “cost-sharing reduction” subsidies, and just before enrollment opened he did.

The nonpartisan Congressional Budget Office predicted that canceling those subsidies — which went to insurers so they in turn could lower costs for lower-income customers — would on average add 20 percent to premiums; that many people would drop coverage; and that companies would pull out of some markets. That did happen and has gotten much publicity.

But the CBO did not predict that everyone would suffer.

The CBO also predicted that other people would get such great deals that they’d opt for new coverage. People who couldn’t afford the best plans before now could afford them.

That appears to be happening, too.

For basic health coverage in 2017, Jenkins’ plan cost him $102 a month (after cost-sharing reductions made it affordable).

In 2018, those subsidies are gone. Now, different subsidies come into play, and because of how the law works, after Trump’s executive order, they’re bigger. So this year, that same type of coverage will cost Jenkins just $38.

It’s such a dramatic discount that he’s opting to add dental and vision, for a total of $99.

None of that would be a surprise to the CBO's analysts. They predicted that overall, the decision to cancel the cost-sharing reduction subsidies — allowing the other, bigger subsidies to kick in — would add $194 billion to the deficit over 10 years.

Dan McBrayer, an agent several counties away from Jenkins, doesn’t think much of these developments.

“The people that’s getting a tax credit are getting a bigger tax credit,” he said. “The people that aren’t are getting a bigger bill.”

McBrayer concluded, “Quite frankly, this thing is such a train wreck.”

McBrayer has a lot of clients who fall above the subsidy threshold of making about $48,000 for a single person’s household, and they are getting clobbered with the full force of massive premium hikes. Many of them feel they have to drop insurance, he said.

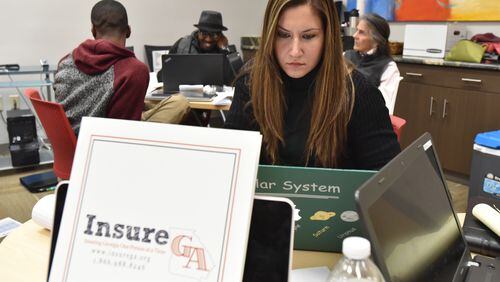

On the other end of the spectrum, Kirk Lyman-Barner, Jenkins’ agent, has a lot of clients who make less money and qualify for strong subsidies. Even as the insurance companies raised rates this year, the subsidies came in even stronger to make the consumer’s cost low. Some are even getting premiums of zero this year, mostly older people.

“Every single one of them is better off except for the folks that don’t get the benefit,” Lyman Barner said. “For those folks it really breaks my heart. Because it was unnecessary.”

Jenkins’ cheaper plan is not a fluke.

An analysis calculated for The Atlanta Journal-Constitution by researchers for the nonprofit Kaiser Family Foundation showed the phenomenon holds. According to those figures, a 40-year-old ACA policyholder in Atlanta making $24,000 a year would see a dramatic price drop for the lowest-cost “gold” plan. In 2017, that policyholder would be paying about $235 per month. But in 2018, that plan would cost that person just $175.

The plan wouldn’t cost less to provide. The insurance company on average hiked the overall price from $380 a month to $465. But the policyholder wouldn’t see that increase because taxpayers would take the hit. The formulas are all spelled out in the law.

There is wide agreement that the subsidy set-up is a problem, and some centrist U.S. senators briefly attempted to fix it. That fell apart in the GOP’s renewed attempt to repeal the law at the last minute in September.

Trump has said his decision on the subsidies would force Congress' hand. In the meantime, critics of the law say blame it, not the president for trying to undo what pieces he can.

Bill Custer, a health care finance researcher at Georgia State University, wouldn’t say the decision to cancel the cost-sharing reduction subsidies was good or bad. But he did note the results were predicted. “By canceling these CSRs, the Trump administration has increased taxpayer costs for this coverage, increased the deficit and decreased coverage in general,” he said.

It’s impossible to know whether enrollment this year will surpass last year’s. New figures released by the Trump administration for the second week of enrollment show that in the first 11 days, nearly 1.5 million people signed up for plans, compared with just 1 million people in the first 12 days last year. But the enrollment period will be half as long. This year it ends Dec. 15.

Jenkins is one of them as he buys his plan. He wishes other people could do that too, though, because health is unpredictable and he thinks the need for health insurance is something that ties everyone.

“I’d prefer everybody to be equal,” he said.

MONEY MONEY MONEY

Different pots of money contribute to the final price of each premium for health insurance plans under the Affordable Care Act. These are some of them:

- Cost-sharing reduction subsidies: This was money that the federal government paid to insurance companies to help the insurance companies lower premium costs for lower-income ACA policyholders. The White House announced this fall that it would stop paying them.

- Premium tax credit: These are subsidies that the federal government has to pay to help make premiums affordable for lower-income ACA policyholders. With the cost-sharing reductions gone, these credits are bigger now.

- Policyholder's out-of-pocket share: This is what's left for the planholder to pay.

About the Author