A fee that boosted the pay of the Fulton County tax commissioner by tens of thousands of dollars annually was eliminated by state lawmakers Wednesday after years of trying.

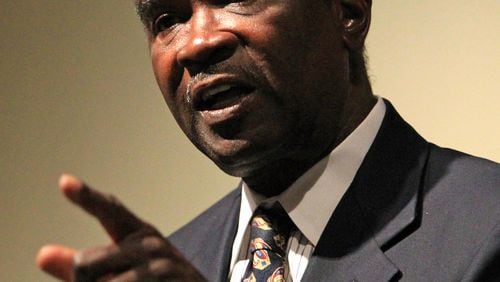

Tax Commissioner Arthur Ferdinand personally collects 50 cents every time he sells a tax lien to a private collection firm or the lien is otherwise paid off. A measure that eliminates that fee passed the state Senate after previously passing the House. It now awaits the governor’s signature.

The Atlanta Journal-Constitution first reported on the fees in 2013. Then, the paper discovered that Ferdinand — who was already Georgia’s highest-paid elected official — earned $383,000 in 2012 between his salary and additional fees.

Between 2011 and the end of 2015, Ferdinand collected more than $200,000 as a result of the fees, according to Fulton County.

Figures for 2016 were not available Wednesday, but Ferdinand’s base salary last year was $158,149.

An interoffice memo shows Ferdinand began seeking the money in 2010, citing an old state law. He initially wanted back payments for about 365,000 liens paid off since 2002.

“At your earliest convenience,” he wrote to Finance Director Patrick O’Connor on Nov. 10, “please issue a check in the name of Arthur E. Ferdinand for the full amount of $182,492, in accordance with State Law.”

The county would only agree to go back to July 2007 with retroactive payments, so in 2011 Ferdinand received a lump sum payment of more than $87,000.

“It’s something that rankled our voters, that resonated with our voters,” said Rep. Brad Raffensperger, R-Johns Creek, who sponsored the bill in the House. “Earning fees on tax liens just is not appropriate state policy.”

The bill is aimed at addressing Ferdinand and Fulton County, though tax commissioners in two other counties, Worth and Douglas, also are eligible to collect such fees. Dan Ray, the executive director for the Georgia Association of Tax Officials, said the Douglas County tax commissioner had not been taking the fee. He did not know about Worth County.

In Douglas and most other counties, Ray said, if the 50-cent fee was collected, it went into the county coffers. The new law eliminates the fee altogether, though Raffensperger said the impact to county budgets will be minimal.

House Speaker Pro Tem Jan Jones, R-Milton, said she was "pleasantly surprised" that the bill limiting Ferdinand's income gained traction this year after having stalled in prior years. Another sponsor, she said Ferdinand appeared to be the only tax commissioner who took advantage of the "obscure" law.

“The elected tax commissioner does not need a financial incentive to do his job, aside from his salary,” Jones said of the additional fees. “Today, the legislature eliminated the fee he personally pocketed for initiating the taking of someone’s home.”

Ferdinand did not respond to a message left at his office or an emailed request for comment. In the past, he has defended the fee-collection practice as legal.

If the governor signs the bill into law, it will go into effect July 1. That means Ferdinand would still be able to collect the fee until that date.

Ferdinand still has another source of income, in addition to his salary: A fee of $1 per parcel for taxes he collects in Atlanta, Johns Creek and Sandy Springs. That fee was not challenged by the legislature.

Ray, with the Georgia Association of Tax Officials, said his organization did not take a stand on the bill — but that he thought there was no problem with the amount of money Ferdinand was bringing in.

“I think he’s well worth what he gets paid,” Ray said. “He’s ultimately responsible for what goes on in that office. …What you’re paying the tax commissioner for is that responsibility.”

Rep. Chuck Martin, R-Alpharetta, said it was time to repeal the “very archaic” form of compensating tax commissioners. He said the office should be incentivized to collect taxes on the first go-round, not once they are overdue.

“This is not the way to run the railroad, so to speak,” he said.

While the fee amounts to very little money in some counties, Fulton reported paying Ferdinand for 422,875 liens through the end of 2015.

“It results in real money in a county as large as Fulton,” Jones said. “It certainly didn’t account for a majority of his pay, but it’s not chump change.”

Staff writer Johnny Edwards contributed to this article.

About the Author