Everyone in DeKalb County will pay higher sales taxes and lower property taxes if voters approve on Election Day. But the total cost of the tax proposals varies widely depending on where you live.

Some homeowners in cities will actually make money if the referendums pass. That's because the property tax break is larger than the cost of the sales tax hike for those residents.

Meanwhile, most residents in unincorporated DeKalb would face higher costs. They would receive a smaller increase in their property tax refund after years of higher tax breaks than city residents.

On average, the tax proposals would cost roughly $80 to $100 per person annually to fund road repaving, fire station repairs and other infrastructure.

Approval of the special purpose local option sales tax (SPLOST) would raise the county's sales tax rate to 8 percent, generating $100 million a year for local governments.

The property tax relief measure, called the equalized homestead option sales tax (EHOST), would return about $22 million a year from existing sales taxes to homeowners. Both the SPLOST and EHOST must pass to be enacted.

The overhaul of DeKalb’s tax structure was designed to treat unincorporated and city residents more evenly while also bringing in more money for county and municipal governments.

Under DeKalb’s existing tax structure, city governments receive almost all of the $22 million in annual countywide sales tax revenue dedicated for infrastructure. At the same time, unincorporated DeKalb residents get larger property tax breaks, but unincorporated areas receive little sales tax money for infrastructure.

The sales tax would cost somewhere between $75 and $150 annually per resident, depending on how much they spend, according to a 2012 Georgia State University study of the impact of a previously proposed sales tax increase. Groceries are exempt from DeKalb's proposed tax, reducing its cost.

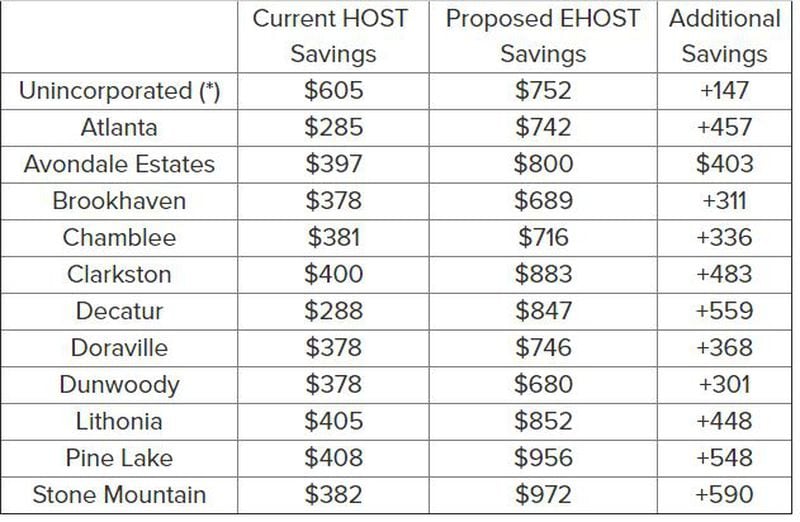

The additional property tax relief would be worth an average of $437 for a $200,000 home in a city, according to the county's analysis. By comparison, the tax credit would increase $147 for a similar property in unincorporated DeKalb.

That would make the total amount refunded for county property taxes about even for all homeowners — $750 to $800 on a $200,000 home.

The discount would apply to property tax rates levied countywide, which fund general county government operations and Grady Hospital. Under the county’s existing tax structure, the refund applies to all county property tax rates, which benefits homeowners in unincorporated areas more than those in cities.

Here are a couple of scenarios showing the cost of the referendums if they pass:

- A family of four with a $200,000 home in unincorporated DeKalb would owe a total of about $253 more in taxes, based on 2017 property tax rates and assuming an increased sales tax cost of $100 per person.

- The same family household in Brookhaven would owe $89 more in overall taxes compared to current rates.

Estimated property tax savings by jurisdiction, according to DeKalb County’s Budget Office:

MYAJC.COM: REAL JOURNALISM. REAL LOCAL IMPACT.

The AJC's Mark Niesse keeps you updated on the latest happenings in DeKalb County government and politics. You'll find more on myAJC.com, including these stories:

Never miss a minute of what's happening in DeKalb politics. Subscribe to myAJC.com.

In other DeKalb news:

About the Author

/cloudfront-us-east-1.images.arcpublishing.com/ajc/P7DYBH6TO7FEKG4SUXQQKADRXE.jpg)