Gwinnett County will lower its 2016 tax rate to account for rising property values.

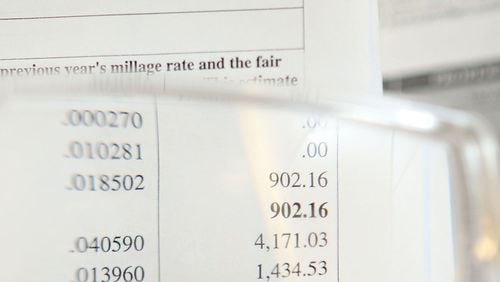

On Tuesday county commissioners approved a general fund property tax rate of about $6.83 per $1,000 of assessed value – 5.6 percent less than last year’s rate. Under the new rate, the owners of a $200,000 home would save about $28 on the general fund portion of their tax bill, assuming the value of their property remained unchanged.

Of course, the value of many homes is rising after years of declines brought on by the Great Recession. According to county records, the county’s net tax digest – the value of all property, minus the value of tax exemptions – rose about 6.2 percent this year. So some homeowners will pay more, despite the lower tax rate.

It’s the second year in a row commissioners have cut the tax rate to account for rising property values. Over the last two years the tax rate has fallen nearly 8 percent.

“We pride ourselves on trying to hold the millage rate down as much as we can,” said Chairman Charlotte Nash. She credited county employees for managing their budgets.

The general fund tax rate pays for countywide services like roads, courts and elections. Gwinnett expects to mail tax bills later this month.