Atlanta mayoral candidate Mary Norwood released nine years of her and her husband's federal tax returns on Monday, arguing that an ongoing federal corruption investigation at Atlanta City Hall required greater transparency.

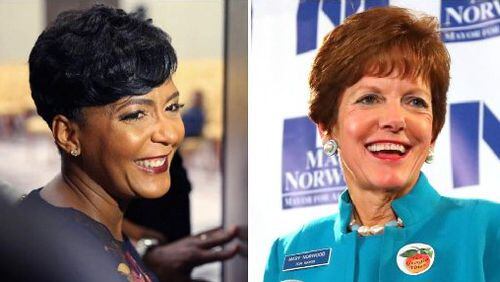

Norwood is in the Dec. 5 runoff against Keisha Lance Bottoms, who said she was open to releasing her returns as well, but first wanted to talk to her accountant.

Norwood’s returns show that she and her husband Felton, a retired physician, made a low of $106,565 in 2010 to a high of $196,551 in 2015. The majority of the couple’s income derives from Felton Norwood’s IRA distributions and dividends from investments.

Norwood’s city council position pays her roughly $50,000 per year. The couple in some years contributed more than 10 percent of their income to charity. In 2013, they donated $18,964 to charitable organizations, while earning $128,023.

Norwood’s campaign initially planned to release only the The Internal Revenue Service’s Form 1040, which provides a summary of income and taxes paid. The Atlanta Journal-Constitution requested the full returns, and Norwood provided hundreds of pages of additional information supplied to the federal government.

The returns do not appear to include the names of organizations to which she donated, with one exception: In 2012, the couple donated decorative furniture appraised at $17,950 to the Hay House, a historic home in Macon owned by the Georgia Trust for Historic Preservation.

Norwood promised to provide itemized lists of her donations soon.

Franklin among first to release returns

Candidates often release their tax returns in state and federal elections, although some high-profile candidates have kept them private in recent years. Donald Trump in 2016 became the first presidential candidate in two generations to not disclose his tax returns.

The practice is less common among mayoral candidates in major metropolitan cities, but exceptions include Rahm Emanuel in Chicago and Bill de Blasio in New York.

"It's case-by-case, candidate-by-candidate," said Michael Leo Owens, a political science professor at Emory University. "I suspect if we didn't have a bribery investigation, this would not be as important or happening at all.

“Is it opportunistic? Sure. Campaigns are meant to be opportunistic. It fits with her message of transparency.”

The first Atlanta mayor to in recent memory to release her returns was Shirley Franklin, who did so in 2001, amid federal bribery investigation at City Hall — one that resulted in former Mayor Bill Campbell receiving a prison sentence for federal tax evasion. Franklin also vowed to not accept any outside income during her tenure and to place her business interests in a blind trust.

“I did it to demonstrate my transparency and to answer any questions about my independence,” Franklin said. “I wanted to show that I would work 100 percent of the city of Atlanta. Transparency is about more than what you say — it’s about how you demonstrate it.”

Some returns released in 2009

In the 2009 general election, mayoral candidate Lisa Borders released her previous year tax return. She challenged current Mayor Kasim Reed and Norwood to do the same.

“Anytime you’re going to serve in public office, a certain amount of transparency is in order,” Borders said.

Reed, an attorney, released a decades worth of tax returns in that election.

Norwood, who lost the 2009 contest to Reed by about 700 votes, did not release her taxes in the 2009 race. She said the pay-to-play bribery allegations at Atlanta City Hall, which has netted three guilty pleas to federal prosecutors this year, played a major role in her decision on Monday.

“I firmly believe that how you handle your own personal and business finances is a great indication as to how you will handle the taxpayers’ money,” Norwood said during a Monday press conference. “My husband I live within our means. We pay our bills. We have had no tax or property liens of any kind.”

That comment referenced Bottom’s past tax liens and unpaid water bills — problems that Bottoms has said arose from medical expenses when she and husband were starting a family.

/cloudfront-us-east-1.images.arcpublishing.com/ajc/P7DYBH6TO7FEKG4SUXQQKADRXE.jpg)