After getting an earful from angry residents over the past week, leaders from across Fulton stepped up on Monday to challenge 2017 property tax assessments that homeowners say could double, triple or, in some cases, quadruple in their tax bills.

The Atlanta City Council on Monday passed a resolution asking the county to delay the 2017 tax assessment digest and requested the Fulton Tax Assessor’s office representatives appear before council to explain its methodology in determining the 2017 assessments. The deadline to appeal tax assessments is July 10.

“My concern is this, that the clock is ticking for thousands and thousands of residents,” City Councilwoman Mary Norwood, who co-sponsored the Atlanta legislation, told her colleagues during a debate that lasted almost an hour.

Meanwhile Fulton County Commission Chairman John Eaves on Monday asked the state revenue department to allow the county to freeze the property tax digest at 2016 levels.

The Atlanta Board of Education, which receives the lion's share of the funding from property taxes, talked about the tax assessment.

“I think the impact on us is going to be crazy,” school board member Nancy Meister said.

“My in box is lighting up too,” board member Cynthia Briscoe Brown said.

Even legislators have gotten involved. Sen. John Albers, R- Roswell, called a meeting of the State and Local Government Operations Committee later this month. He hopes to pass legislation in the next session calling for caps to the increases, which he called "unconscionable."

Since tax assessments began arriving in the mailboxes of Fulton residents last week, Albers said he has gotten 1,200 calls, texts and emails. Homeowners also took to social media, community message boards and to old-fashioned water coolers to complain, commiserate and compare notes.

“This is a big problem,” Albers said. “This really hurts people.”

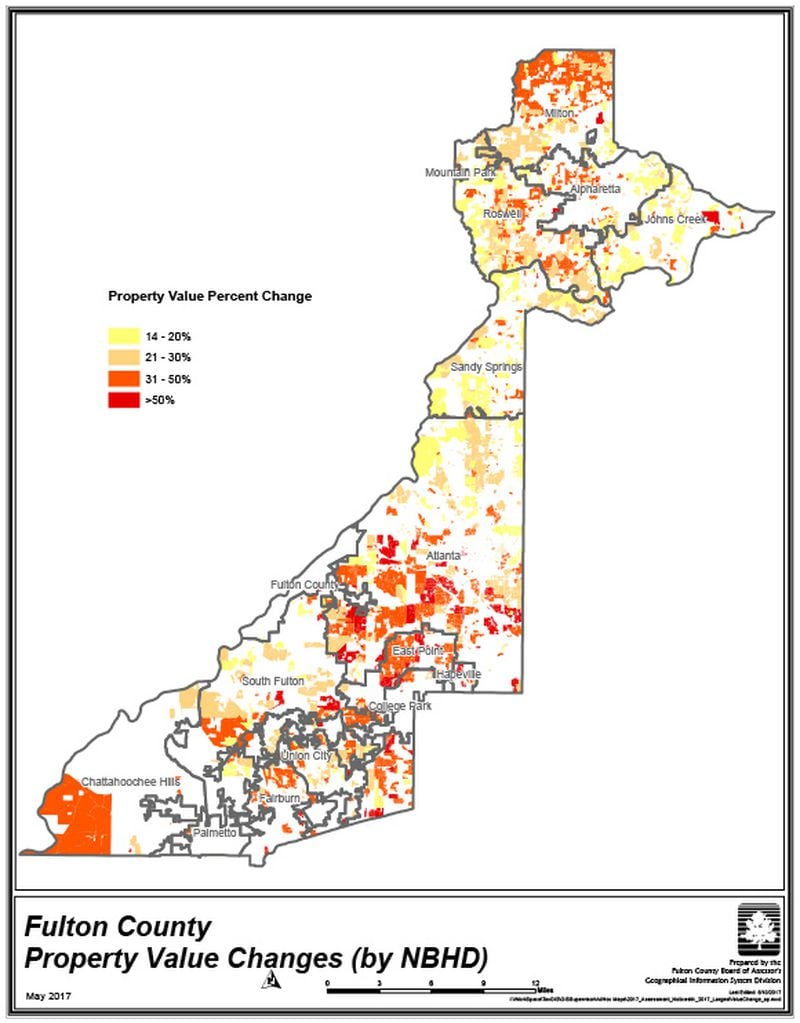

The tax assessor's office late last month warned that there would be a sharp rise in assessments. The reason: Fulton's red hot real estate market and the county's past failure to keep up with rising valuations as the economy improved.

But few apparently were prepared for the sticker shock.

“Got my property tax assessment today and I’m ready to organize a revolt,” North Fulton homeowner James Williams wrote on Twitter.

Eaves, the Fulton Commission chairman, said he met with representatives from the Department of Revenue Monday to ask if the Board of Commissioners has the ability to freeze assessments at last year’s levels, but was told commissioners cannot. The state also declined a request to do so.

Credit: FULTON COUNTY

Credit: FULTON COUNTY

A court could still order a freeze, and Eaves is meeting with members of the Fulton Board of Assessors Tuesday morning to determine if there is anything they can do to reduce assessed values.

The increased valuations come as officials, especially those in the city of Atlanta, are struggling to keeptheir communities affordable. Atlanta has seen a surge in residents as millennials move in to take advantage of Midtown and Buckhead tech jobs, empty nesters downsize to condos to be near theater and restaurants and the Atlanta BeltLine offers city dwellers trails and greenspace comparable to the suburban parks — without the traffic congestion.

That has led to skyrocketing home prices and put homeownership in Atlanta and many of Fulton’s close-in cities like Roswell and Sandy Springs out of reach for firefighters, teachers and police officers.

“This is a huge issue for the city of Atlanta going forward, particularly when we say we want to do things like affordable housing,” said City Councilman Michael Julian Bond. “There really needs to be some serious attention given to this.”

While the assessments had estimated property taxes on them, those numbers will change if cities, school boards and the county reduce the millage rate to account for increases in value. Still, those whose property values increased above the median will still see an increase in their costs.

Eaves encouraged homeowners to appeal.

Atlanta City Councilwoman Felicia Moore, who sponsored the resolution with Norwood, said the tax assessor’s office could have handled the situation better. Homeowners could have been notified of the increase and then offered a phased increase so that they could budget the additional cost.

“When you try to do this in one swoop, it’s going to cause sticker shock,” she said.

She added that the problems don’t stop at homeowners. Renters also will see hikes in their monthly payments as property owners pass on the increased costs. In addition, insurance companies can raise the cost of coverage because of the increase in the home’s value.

“What this does is cause a lot of disruption in the community,” she said.

Staff writer Molly Bloom contributed to this article.

MYAJC.COM: REAL JOURNALISM. REAL LOCAL IMPACT.

The AJC's Arielle Kass keeps you updated on the latest happenings in Fulton County government and politics. You'll find more on myAJC.com, including these stories:

Never miss a minute of what's happening in Fulton politics. Subscribe to myAJC.com.

In other Fulton news: