One big item in Republican tax plans would make figuring out our individual income taxes a little less crazy. But it comes at a price.

So here’s a basic question millions of Americans may soon face, one that highlights the link between behavior and money:

Will we donate less to charities if it’s harder to get a tax break for doing so?

Nonprofit leaders are nervous. In fact, they fear they might lose billions of dollars in donations. Because while the deductions for charitable contributions won’t go away, they (and some others such as a deduction for mortgage interest) would become way less relevant under the GOP tax plans.

"They are keeping these deductions in name, but they are effectively going away for lots of folks," said Gregg Polsky, a University of Georgia professor whose focuses include tax law.

Initial proposals in both the House and Senate would nearly double the allowed standard deduction (from $6,350 to about $12,000 for singles, and from $12,700 to about $24,000 for married couples filing jointly).

On the surface, this sounds like the government just gave us our wallets back.

In reality it’s a bit more complicated than that, though it looks like most people will end up paying less in taxes. (Avert your eyes from this line if you don’t like headaches: while increasing the standard deduction, the proposals eliminate personal exemptions of $4,050 per person, but also boost child tax credits and offer temporary new credits, but also mess with or eliminate other deductions.)

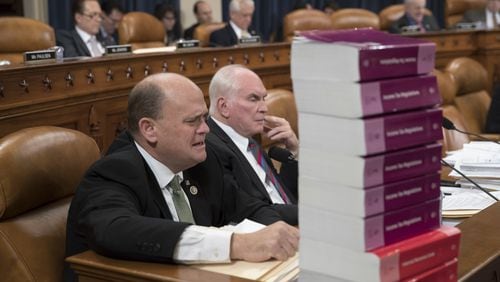

For this piece, I endured reading much of the gazillion-page tax proposals.

Then I did some math. Taxes for my family would have been about $250 lower had the House’s proposed plan been in place last year.

One big deduction or many little ones

Every year, tens of millions of individual U.S. taxpayers have to decide whether it’s a better deal to take the standard deduction or to itemize deductions for things like charitable donations, home mortgage interest, state income taxes, real estate taxes, car taxes and medical expenses.

Itemizing adds more complexity and time to what’s already a grueling process. But if it can save you hundreds or thousands of dollars, it’s worth it for lots of people.

Nearly one in three people who file taxes itemize now. That could plummet to one in 20 if Congress essentially doubles the standard deduction as proposed, according to Richard Schmalbeck, a Duke University law professor who specializes in tax issues.

People who don’t itemize no longer have a tax incentive to give to charities.

Here's why that's a big deal, using some math from wonks at the Tax Policy Center: Someone with a tax rate that goes as high as 28 percent could give a $100 donation to a charity, but they'd see a $28 drop in taxes with the deduction. Which means that $100 donation ultimately only cost them $72.

I got in touch with Habitat for Humanity International, a pretty wonderful organization that does good by helping people get homes of their own.

“Habitat for Humanity has serious concerns about the proposed tax bill’s impact on charitable giving,” Chris Vincent, a vice president for the organization, said in a statement emailed to me. “Habitat strongly urges Congress to preserve and enhance charitable giving incentives, to preserve the vital work that organizations like Habitat do with low-income families across the country.”

Credit: Courtesy photo

Credit: Courtesy photo

Transformational giving

A United Way survey from a few years back suggested that 30 percent of Americans would give less if there was no tax incentive.

Alicia Philipp, the president of the Community Foundation for Greater Atlanta, told me she thinks people will still give money to nonprofits, they'll just give less.

What also worries her are simultaneous proposals to reduce estate taxes paid by the wealthiest segment of society.

She works with some of those folks, and I think she’d love to see them and their heirs continue to thrive financially.

But some give large donations as part of their estate planning, which includes the idea of preferring to give money to charities rather than to Uncle Sam.

“Those transformational gifts are what change a community,” Philipp told me. “I talk to a lot of estate planning attorneys …. They say 50 percent of their clients would actually change their behavior if this goes through.”

Alarm clock for generosity

Our tax code works like an alarm clock for generosity. It rouses us and encourages us to donate now, before the end of the tax year or, if you’re rich, before you die, rather than procrastinating until who knows when.

Try visiting a Salvation Army or Goodwill drop-off in the last few days of the year. Some centers hire police officers to manage the crush of people trying to donate items in time to claim them on their next income tax forms.

"New Year's Eve is that magical time in the financial year when we Americans become incredibly charitable, in part because we are a little greedy," I wrote in a past column. "Isn't it beautiful when self-interest collides with societal interest?"

A columnist’s taxes

Keep in mind that the federal tax code is rife with exceptions and loopholes that help out some and not others. The tax proposals don’t come close to fully reforming the system.

They only modestly address one of the biggest flaws in our federal income tax structure: it is far too complex.

Regular families shouldn’t feel they need to hire accountants or pay for tax software just to make sure they are abiding by the law and paying neither more nor less in taxes than required.

Something is messed up when a business columnist (moi) spends flummoxed hours preparing the family income tax forms, which aren’t particularly exotic. If I have to devote this much effort, how fair is the tax code for those people who don’t make a living digging into financial complexities?

We can do better.

Related coverage:

Find Matt on Facebook (https://www.facebook.com/mattkempnercolumnist) and Twitter (@MattKempner) or email him at mkempner@ajc.com.

MYAJC.COM: REAL JOURNALISM. REAL LOCAL IMPACT.

AJC Unofficial Business columnist Matt Kempner offers you a unique look at the business scene in metro Atlanta and beyond. You'll find more on myAJC.com, including these columns:

Never miss a minute of what's happening in local business news. Subscribe to myAJC.com.